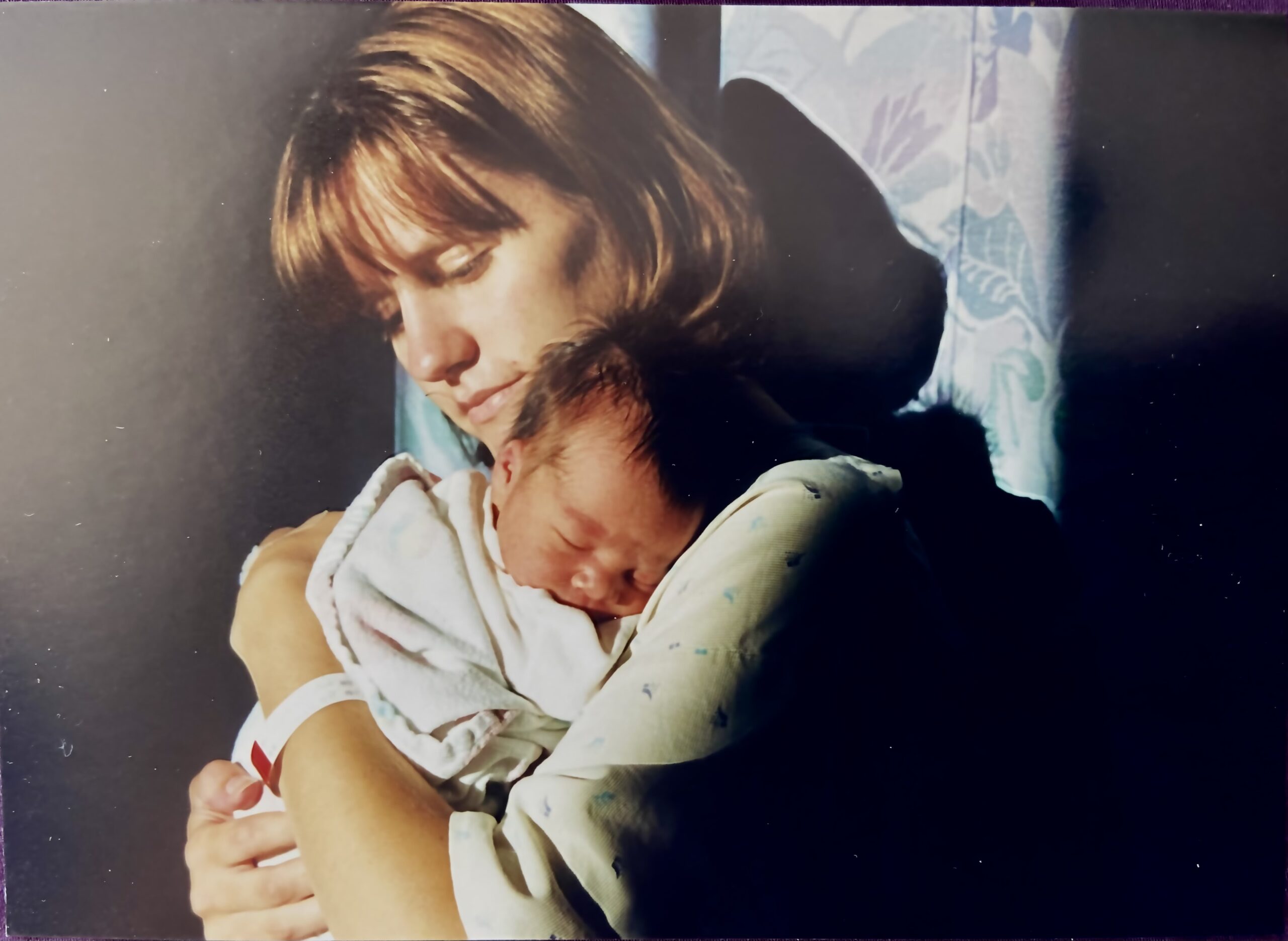

Imagine yourself a 21-year-old woman, in 1999, who has recently found herself a single mother to a newborn baby girl. 25 years ago, my mom found herself in this exact situation. We were extremely lucky to have a strong support system to fall back on, but many who find themselves in similar situations aren’t quite so lucky.

Looking back, I grew up very poor. My mom was earning less than $20,000/year and I shared a bedroom with her in my grandma’s two-bedroom house in a town with a population of 4,487.

I never would have known it, though.

Maybe it’s because I grew up in one of the poorest areas in the state, but I believe it was actually because I had an amazing mom who cared for me, provided everything I could have ever wanted, and taught me to appreciate the small things in life with a deep passion.

I still remember hitting my first “over the fence home run” with a plastic bat and whiffle ball in our backyard and using the laundry line posts as a makeshift goal for practicing soccer. I remember the makeshift swing, made from a few solid pieces of wood and cord, hung from the crabapple tree that always went a little crooked. I remember learning to cook pancakes from my grandma and I remember my favorite Christmas present (a lifesize baby doll I named Angelina I dragged around everywhere with me for years).

Here’s what I don’t remember. I don’t remember my mom or grandma worrying about how they were going to pay a bill. I don’t remember the power ever being cut off or feeling cold because we didn’t have heat. I don’t remember ever worrying about when my next meal would be. I don’t remember ever having to give up a club or activity or passion because we couldn’t afford it.

A large part of this is because my mom was able to access multiple resources and supports. She received both TANF and Medicaid. My grandma owned her house, so my mom only had to pay for the water, heating, and electric bills as her “rent” to my grandma. She was able to access scholarships that allowed her to go back to school, connecting her to her 16-year career in early childhood.

While the public benefits she received kept our small family afloat, they also came with many frustrations, unexpected drawbacks, and ridiculous requirements. Upon talking with my mom about how she managed one thing she stressed was that these “systems are really hard for low-income people to navigate.”

One of the first barriers she encountered was applying for benefits. When she first considered applying, she was told she didn’t qualify because she owned a car. Selling it was not an option, it would further isolate her and prevent her from getting a job (our town does not have a public transit system in place that she’d have been able to use to get to and from work) so she withdrew her application. However, once she moved in with my grandma, even though she was just 30 minutes away from where she had been living previously, she was in a new county. This county allowed her to receive benefits and keep her car.

But once she had those benefits, keeping them was almost a full-time job.

First, were all the notices. They were full of terminology and jargon that she didn’t understand making it nearly impossible to know everything she was entitled to and all the requirements to keep her benefits. And even then, some vital information was not communicated to her, leaving her surprised when her TANF benefits suddenly ended after two years. “Thankfully, I had chosen a two-year degree program or I would have been left in the middle of my degree having to figure out how to pay for two more years.”

Then, there were both strict and impossible-to-meet requirements.

“I was required to work a certain number of hours, maybe 25 or 30/week, without going over a certain income threshold.” But working the required hours at minimum wage put her over that threshold. This rule is so nonsensical it seems akin to sabotage, but thankfully she discovered that attending classes counted towards these work hours and pay for work-study didn’t count as income. So she decided “I needed to get a degree.” But even then, work-study pay only didn’t count when school was in session. While this rule might make sense on paper, in action it left my mom scrambling during the summer to make up the sudden loss of income, despite working the same number of hours with the same employer.

“I worked part-time at minimum wage and it put me $5 over the threshold during the summer. I had been getting around $750 a month, but I lost it all because I went $5 over. It was a huge loss of income, which was really stressful and made the system feel broken.”

She was also required to physically mail her paystubs as proof of income, which often were delayed or late and frequently led to her benefits being cut off. In order to receive her benefits again, she was forced to drive an hour or more to the only physical office in the area for a face-to-face meeting. Even though it usually worked out okay in the end, the fear of losing her monetary support was hard.

“I was in tears every single time.”

Then came the real soul-crushing realization. That after more than 10 years of working hard, earning both an associate’s degree and a bachelor’s degree, and earning trust and esteem in her career, her promotion meant she lost her benefits and was still not able to be self-sufficient.

A few years later, I experienced a similar soul-crushing situation when I finally found a job I loved. I had been working part-time on top of my AmeriCorps position and was I being offered a full-time position. It was a dream come true. But when I looked at the numbers, I realized I would lose my SNAP and potentially my Medicaid benefits, and for the first time in my life, I wondered if taking my dream job, earning a real salary, would force me to choose between paying rent or eating dinner one day.

So even though I grew up not realizing just how poor our family was in part because of public benefits, even though I was able to be treated as an infant for a serious fever because we had Medicaid, and even though my mom discovered a lifelong love for early childhood and learning because she was pushed into degree programs, these systems of support need to be better. Because they also increase the stress and burden on struggling families counting every penny, because rules and regulations set them up to fail. Because the Medicaid standard dental procedures led to lifelong teeth issues for my mom, including difficulty eating certain foods and expensive corrective procedures later in life. Because dream jobs and promotions become things to be feared.

“They can make low-income people feel less than.”

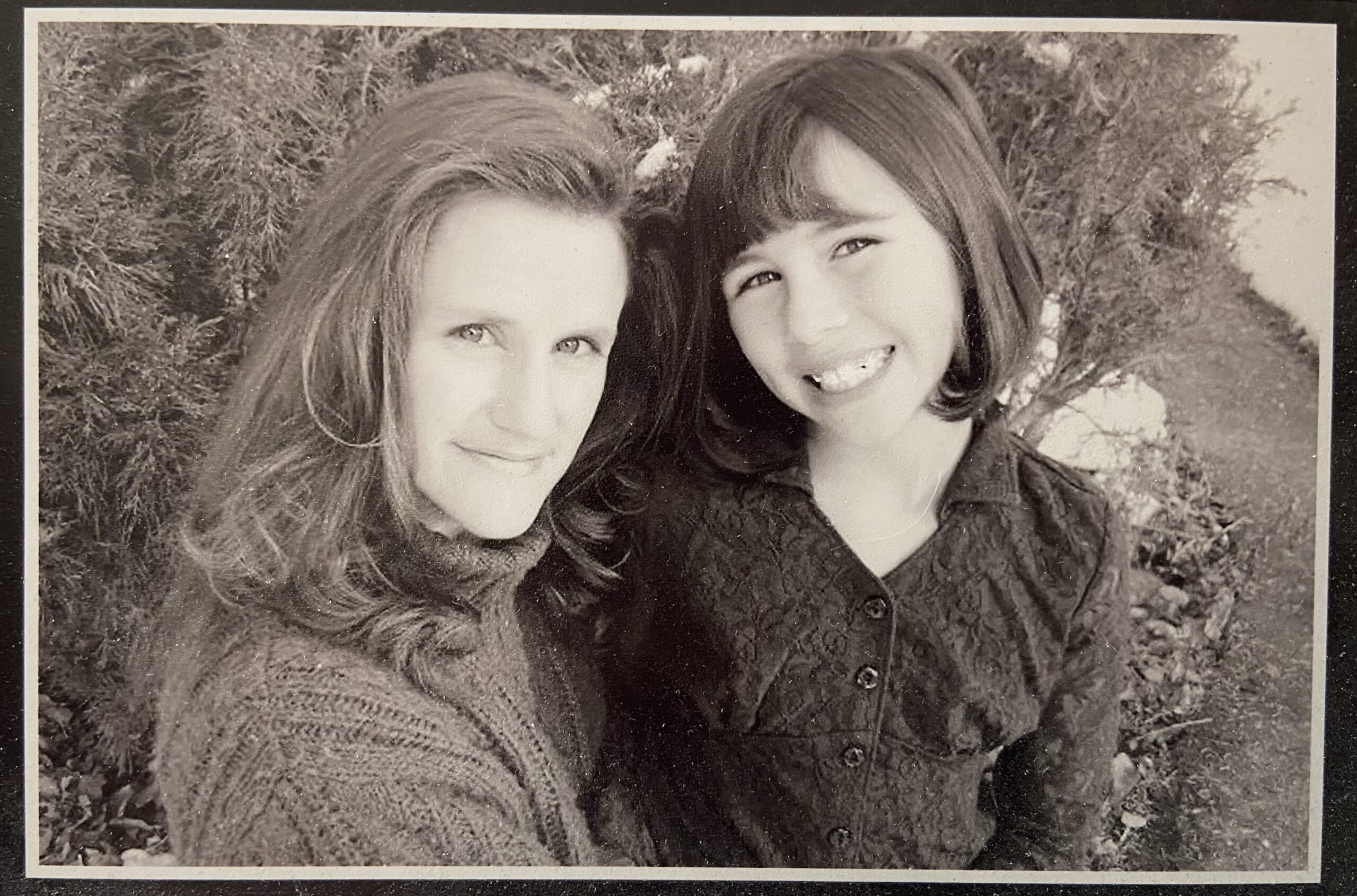

My mom and I were lucky. We had family who agreed to take us in for nearly 15 years, we had employers who were willing to be flexible with our hours and benefits so we could keep working and keep our benefits, and we’ve been able to save money for life’s unexpected expenses. But many are not quite as lucky as we were.

It is about time we fix these systems. Thoughtfully designing programs to remove as many barriers as possible to accessing and keeping support. Allowing people to move up in their careers without losing hundreds or thousands of dollars in the process. And most importantly, giving people back their dignity.

It is time to bring love and hope back into the money equation.

Written by Natasha Couoh

LIFT National Communications Intern and Each Day Communications Account Manager